By Otfried Nassauer

This Text is also available in the following languages:

Since 2004, Rheinmetall AG has been the owner of the Oberndorf arms manufacturer. Rheinmetall, like Mauser, has a very long history as an arms-making group. The core business of the public limited company has consisted for almost 130 years in making money throughout the world with arms and ammunition – including in Turkey. In 1899, its founder, Heinrich Ehrhardt, succeed in landing the first Turkish order for ammunition for his company. But Rheinmetall competed for a long time without success on the Bosporus for orders for cannons. But in the end, they succeeded, for reports say that Rheinmetall guns were also used by the Turks at the latest

Today, Rheinmetall has been doing business in Turkey for well over a hundred years. Arms, military equipment, and licenses have been supplied. And the company would like to continue to be involved in Ankara — for exampling, in modernizing and building Turkish battle tanks and in manufacturing ammunition. Joint ventures are one method Rheinmetall hopes to use for this. Furthermore, cannons and machine guns developed or manufactured by Rheinmetall are being employed in Turkey’s

interventions in northern Syria, including against Kurdish forces in

Rheinmetall has integrated the Mauser Works in Oberndorf purchased from the Diehl group as the Mauser branch into its Weapons and Ammunition division (RWM). Rheinmetall has concentrated the German part of its development and production of machine guns and rapid- fire cannons there. The cannons are offered to armies, navies, and air forces. The 27-mm

aircraft cannon BK27, the light naval gun MLG 27, and the machine

cannons of the RMK30 series are among the best-known Rheinmetall products from Oberndorf. The aircraft cannon is employed in the European combat aircraft Alpha Jet, Tornado, Eurofighter, and Gripen, for example, the MLG 27 as a weapon on many warships and navy boats, and different versions of the RMK30 are used as weapons on armored vehicles and warships.

1.An overview of the company

The firm of Rheinische Metallwaren- und Maschinenfabrik AG, founded in 1889, doing business today as Rheinmetall AG, began its operations as an ammunition and cannon manufacturer, and is currently the largest arms maker based in Germany.

Rheinmetall consists today of two roughly equal-sized divisions, Defence and Automotive. Its headquarters are in Düsseldorf. The company is a global player, with 39 German locations and 78 foreign one in 30 countries. It stated that in 2017, it had holdings in a total of 186 firms, and customers in 146 countries. 23,726 were working for the Group, of whom 11,798

at home and 11,928 abroad. The Defence division employed 11,232, and the Automotive division 12,277.

In 2017, the Rheinmetall Group had sales of about 5.9 billion euros (2016: 5.6 billion). About 2.9 billion euros came from the Automotive division (2016: 2.7 billion), and somewhat more, a good 3 billion, from the Defence division (2016: 2.9 billion). The operative result of the Group, that is earnings before taxes and special effects, amounted to about 400 million euros in 2017 (after 353 millions in 2016). With an order book of about 6.4 billion euros, at the end of 2017 the Defence division had a backlog of orders that made good capacity utilization and increasing profits in the future seem likely.

For 2018, the management expects a growth in sales in the arms sector of 12% to 14%. Even more pleasing for the Rheinmetall managers and their investors is presumably the expectation that investments in armaments are supposed to increase considerably in Germany and many other European NATO countries in coming years, and longer-term market growth is expected.

Uncertainty and fear of war are good for business. Most analysts and investors seem to share this view, as well. The price of Rheinmetall shares increased over the last five years from about 36 euros to about 110 euros. In 2017, it rose by 66%, much more than the stock-market indexes DAX (13%) and MDAX (18%).

2.The Rheinmetall Defence division

The arms sector of the Rheinmetall Group is currently divided into three roughly equal divisions:

Vehicle Systems, such as the Fuchs and Boxer wheeled armored vehicles, military trucks in cooperation with MAN, and collaboration on tracked vehicles such as the infantry fighting vehicle Puma, the Leopard battle tank, and the PzH 2000 self- propelled howitzer in collaboration with KMW),

Weapons and Ammunition (e.g. machine guns, rapid-fire cannons, ammunition, propellant charges, protective systems), and

Electronic Solutions, formerly Rheinmetall Defence Electronics (RDE) (military and security-related electronics, simulators, reconnaissance systems and sensors, radar systems, training systems such as combat training centers, command and networking technology, and anti-aircraft systems).

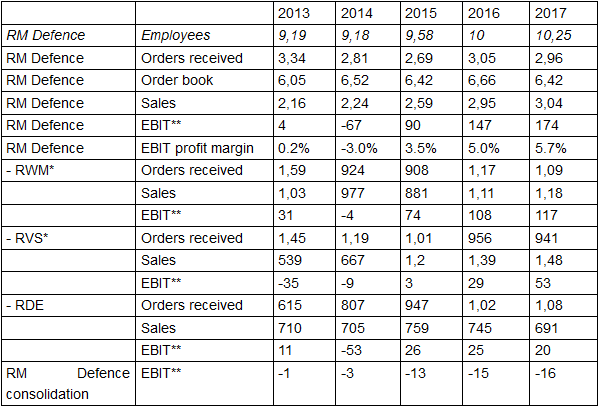

Key parameters of the commercial development of the three armaments divisions can be obtained from the annual financial statements and presentations for financial analysts. The following table traces the most recent five years of Rheinmetall’s arms business:

3.Rheinmetall Defence key parameters 2013-2017

(in million of euros)

* until 2014 Combat Platforms or Wheeled Vehicles

These figures show clearly that the Weapons and Ammunition division made the biggest contribution to the company’s commercial success in recent years. RWM’s contribution to the operating earnings of Rheinmetall Defence increased from 74 million euros (2015) to 108

million (2016), and then 117 million euros (2017). In each case, this was about two-thirds of operating earnings of the entire arms business. With 10% of the turnover, the Weapons and Ammunition division also showed the highest operating yield in 2017 (after 9.7% in 2016 and 8.4% in 2015). Rheinmetall gives as the main reason for this „high-profit-margin sales of ammunition“.

For a conference of financial analysts in the spring of 2018, the Rheinmetall managing board even said with regard to the fourth quarter of 2017: „The Weapons and Ammunition division increased its sales by about 10%, and improved its operating margin from 16.1% to 17.9% — based on a larger share of profitable ammunition sales among our international firms, and on

an advantageous product mix.“ So ammunition exports by foreign firms in the Group are of particular importance for the Group’s success.

4.The ammunition group

So let us cast an eye on this specific and especially profitable field of business. During the last

two decades, Rheinmetall AG has purchased numerous, particularly European, firms that are active in the field of ammunition manufacturing. In addition, it has acquired holdings in a number of joint-venture firms that are involved in this sector. On the one hand, this international engagement has enlarged the Group’s product range by new ammunition offerings, and on the other hand, has enabled the Group to offer its customers types of

ammunition in its export business which are not covered by German intellectual-property rights.

This created expanded possibilities for supplying customers without German arms-export licenses. The following diagram represents the most important firms of the Rheinmetall AG Group in the field of ammunition:

Press releases from Rheinmetall AG on major ammunition orders for the Group during the period 2013-2017 make the importance of this field of business for the company apparent:

5.major ammunition orders for rheinmetall ag, 2013-2017

Year Order Recipient

- 2017 Ammunition order for about 65 million euros to Rheinmetall Denel Munitions (RDM) Unnamed customer

- 2016 Ammunition order for MK80-series bombs to RWM Italia for over 400 million euros, with seven-year duration International customer (Saudi Arabia)

- 2016 Order for over 225 million euros for MK80-series bombs to RWM Italia in cooperation with a firm in the recipient country European customer (France)

- 2016 Artillery ammunition and propellant charges for 130 million euros to Rheinmetall Denel Munitions (RDM). Delivery: by the end of 2019 Unnamed customer

- 2015 Order for DM78 120-mm practice ammunition for 20 million euros International customer

2015 Order worth 39 million euros for DM63 120-mm tank ammunition International customer - 2014 Order for 120-mm tank ammunition worth 53 million euros Greece

- 2014 Supplying the French firm Nexter with ammunition components (propellant powder) for ten years France

- 2013 Order to Rheinmetall Denel Munitions for 120-mm ammunition for a mobile mortar system worth 50 million euros Customer from MENA country

- 2013 Order for 50,000 rounds of 40 x 53-mm shells worth 8.7 million euros Italy

Only selected major orders for ammunition, which Rheinmetall announced in a press release, are listed. Deliveries of ammunition for machine cannons, such as Skyguard anti-aircraft systems, or decoy munitions for ship defense for the MASS system, are not covered.

A presentation by the former Rheinmetall manager Dr. Andreas Schwer to financial analysts made it clear already in 2013 that deliveries of ammunition to the mostly autocratically governed countries of the crisis regions of the Near and Middle East and North Africa (MENA region) are of particular commercial importance for the firm: in the past twelve months, Schwer said, the Rheinmetall Group had acquired „five orders from countries of the Gulf Cooperation Council (GCC) for artillery and tank ammunition for 350 million euros“, naval ammunition orders „from the MENA region for 320 million euros“, and also the ammunition part of a large order for tanks and howitzers from Qatar worth 475 million euros overall. Rheinmetall AG, Dr. Schwer said with some pride at that time, had become one of the three largest manufacturers of large-caliber and medium-caliber ammunition in the world.

But the press releases also contain a second, important indication: Rheinmetall companies abroad, especially RWM Italia and the joint venture Rheinmetall Denel Munition in South Africa, received the export orders making up the majority of the sales volume – and often for deliveries to countries for which there might not have been an export license for ammunition exports in Germany, due to the human-rights situation and/or their involvement in current wars.

Internationalization as a strategy

This is no coincidence. For more than ten years, Rheinmetall AG has been pursuing a strategy of internationalization. Its argument is that, since Germany orders too little military equipment, and at the same time is very restrictive with arms-export licenses, the firm is forced to internationalize its business and produce increasingly abroad, and without making

use of German intellectual-property rights that would give the German government the right of approval. Only in this way can Rheinmetall maintain its military competence and capacities, and utilize the production capacity. Four partially overlapping elements of this strategy can be seen, particularly in the „high-margin“, in other words, especially profitable, ammunition business:

- Acquisition of foreign ammunition producers in countries where export licenses for

„problematical“ recipient countries are easier to obtain than in Germany, and setting

up new joint-venture firms - Increased global winning of orders by the parent company for these firms which are

run by Rheinmetall, but do not have to give any consideration to German arms-export

regulations - Expansion of the production and R&D capacities there, and,

- Setting up ammunition-production capacities in „problematical“ recipient countries

that require production-engineering assistance and ancillary supplies from other

members of the Rheinmetall Group.

6.rmw italia

In 2010, Rheinmetall AG purchased the Italian ammunition manufacturer S.E.I. (Socieda Explosivi Industriali), with factories in Ghedi in northern Italy and Domusnovas on Sardinia, which was in difficulties. The firm was transformed into RWM Italia S.p.A.. RWM Italia produces conventional and insensitive explosives, naval ammunition, and – what is currently

its most important export item – bombs of the MK 80 series under US. license. These are also used in many guided bombs, such as the Paveway series, and bunker-busters of the BLU-109 series, having thus a wide range of application.

The most important customers of RWM Italia in recent years have been Saudi Arabia and the United Arab Emirates (UAE). There were also smaller orders from Italy, Britain (Raytheon Systems Ltd.), Turkey (Roketsan, Tübitak Sage, MKE), South Africa, and other countries. Saudi Arabia and the UAE are currently waging war in Yemen, and thus have a large demand for bombs, guided bombs, and their components, which can be met by RWM Italia. Their

demand for MK 80 bombs caused a very substantial increase in sales. While RWM Italia’s annual sales volume after the acquisition by Rheinmetall amounted to a mere eleven million euros according to the latter, it increased to more than 71 million euros by 2016, according to RWM Italia.

According to RWM Italia’s annual financial statements, more than two-thirds of its sales were to these two customers alone between 2014 and 2016. In 2016, 83% of turn-over was in the MENA region. Exports amounted to at least 90% of sales in each of these years. Saudi Arabia is supplied not only directly, but also indirectly via Britain. Saudi Arabia ordered substantial

quantities of Paveway IV guided bombs from Raytheon Systems UK; the bomb itself, a model MK 82, is also manufactured by RWM Italia. According to British reports, Raytheon UK sometimes even delivered Paveway IVs to Saudi Arabia that had actually been produced for the British Royal Air Force, because the Saudi demand was so urgent.

Amnesty International and Human Rights Watch have proved that MK 82 and MK 83 bombs and Paveway IV guided bombs from RWM Italia have been used against military and civilian targets in the Yemen war. A commission of experts of the United Nations came to the same finding in early 2017, and concluded that numerous uses of this weapon raise substantial

doubts about whether they are permissible under the rules of the international law of war and international humanitarian law.

Rheinmetall has now begun to modernize and expand its production capacities at RWM Italia in Sardinia, at a cost of about 30 to 40 million euros. In particular, the production, processing, and loading capacity for modern insensitive explosives is being enlarged. The reason is

another major order from Saudi Arabia. In 2016, the Arab kingdom ordered 411 million euros‘ worth of MK 80 series bombs from RWM-Italia, according to the Italian government’s annual report for 2016 on its arms-export licenses, and a press release from Rheinmetall. The bombs are to be supplied over a period of seven years.

Since RWM was also able to obtain a sizable order for bombs of this type from France, Rheinmetall now hopes to be able to increase the annual sales of its Italian subsidiary to 100 million euros in the medium term. Additional orders and joint ventures are supposed to help, for example setting up an assembly plant for bombs of the MK 80 series in collaboration with

Nitro-Chem S.A. in Poland, which was initiated in 2017.

7.rdm-the joint venture in south afrika

In 2008, after three years of preliminary discussions, Rheinmetall purchased a 51% share of the ammunition sector of the South African State arms corporation Denel, and transferred this to the new joint-venture firm Rheinmetall Denel Munitions (Pty) Ltd. Production at the four South African sites Somerset West (propellant and propellant charges, formerly Somchem),

Wellington (chemical products, formerly Somchem); Boksburg (metal components, formerly Swartklip) and Potchefstroom/Boskop (ammunition charging, formerly Naschem) was converted successively to NATO standards, and has been modernized and expanded continuously since then. A few years later, RWM together with RDM acquired a fuze manufacturer in South Africa, Laingsdale Engineering Ltd.

RDM can provide a very wide range of standard ammunition for armies, navies, and air forces, including grenades, mortar and artillery ammunition, shells for naval cannons and MK 80 series bombs. In addition, there are propellants and propellant charges, as well as ancillaries for guided bombs that are marketed by Denel.

For many products, the firm does not depend on foreign intellectual-property rights, because the United Nations arms embargo during the apartheid regime caused South Africa’s state arms industry to develop many things itself or procure them illegally. The result was often their own developments and independence in intellectual-property rights — especially in the field of ammunition. Laingsdale Engineering as a fuze manufacturer is a suitable supplement that makes it possible to offer customers complete munitions, including the matching fuze systems. After the end of the UN embargo, RDM successfully launched a modern family of mortar ammunition, and also introduced a family of 105-mm and 155-mm artillery shells (Assegai shells) originally developed in collaboration with a US. firm. Both product lines are now being marketed successfully. The customers now include, besides the USA, the UAE, Australia, Qatar, and most likely also Saudi Arabia.

From the founding of RDM on, Rheinmetall had the intention of entering markets where exports present legal problems from South Africa with this joint venture: the South African joint-venture firm was intended to handle markets in the Near and Middle East, in North Africa, southeast Asia, and Latin America, while the parent company dealt with obtaining orders and with exports to countries presenting no legal problems for arms exports.

This approach proved to be extremely successful. Management change and initial orders from the USA and the United Arab Emirates soon got RDM out of the red. As early as 2011, RDM courted Saudi Arabia and demonstrated its new 155-mm Assegai artillery shells there. Rheinmetall passed an order to supply Qatar with ammunition for the German model PzH 2000 self-propelled howitzers on to RDM. Since then, RDM has enjoyed growing sales,

profits, and order books. These are large enough to promote the development of new ammunition in South Africa and expand the capacity of the factories still further. Rheinmetall Defence has the objective of increasing the annual sales volume of RDM to 250 million euros.

So financially, things are working out as planned. The former Rheinmetall manager Andreas Schwer mentioned in an interview in 2017 that sales by RDM have increased sixfold. The German managing director of RDM, Norbert Schulz, called their involvement in South Africa „the best business decision that Rheinmetall made in the last twenty years“ in 2014. At that time, Saudi Arabia, the United Arab Emirates and Singapore were already named as RDM’s most important customers. One reason South Africa has proved to be a „good“ site is that, while on paper it follows strict arms-export policies, in practice permits are very easy to obtain there. This is partly due to the fact that the South African government is usually the owner, or in the case of RDM, the co-owner of the firms applying for the permits, and thus shares in the profits.

Ammunition factories for the world

Rheinmetall Denel has also specialized in exporting entire ammunition factories and ammunition charging facilities to recipient countries, some of which are extremely controversial. The firm claims to have build 39 such plants in somewhat over three decades. Each year, two or three more are added, they say. From the period of the joint venture with Rheinmetall, three such critical exports have become public knowledge:

• Starting in 2008, RDM erected for Rheinmetall in the Emirate of Abu Dhabi a turn-key ammunition factory for a joint-venture firm named Burkan Munitions Systems Ltd., in which Rheinmetall held a 40% share until 2012. As agreed, this holding was sold to their business associates in the emirates once the plant was completed. Firms of the Rheinmetall Group, such as RWM Italia and RDM continued to function as suppliers and to provide technical

assistance.

• In 2016, another such plant was commissioned in al-Karij in Saudi Arabia, that is operated by the Saudi government Military Industries Corporation. According to reports in the media, the volume of the transaction was 240 million dollars. According to tender documents that became public, RDM offered Saudi Arabia a plant with a capacity of 600 mortar or 300 artillery shells per shift. Rheinmetall AG does not have a holding in this plant, but stated that Group firms assist in the operation of the plant.

• This year, according to media reports, another such plant is to go into operation, this time in Egypt. The plant was almost completed at the end of 2017, RDM stated. In public, they usually speak of a „customer in North Africa“.

Erecting such plants serves several important interests of the recipient countries simultaneously, and also the Rheinmetall Group’s interest in profits. The customer countries can retain some of the added value from their arms purchases in their own country. After the purchase, it is mostly the costs of licenses, of technical assistance in operating the plants, and

of bought-in components that go abroad. Thus the often autocratically-ruled customer countries become more independent of the arms-export licensing policies of the supplying countries.

Their domestic policies (human rights) and foreign policies (conflicts and wars) can be influenced considerably less by pressure from the supplying countries. In addition, they can obtain orders for arms exports themselves. And finally, the political and/or military elites in these countries quite often create an additional source of revenue for themselves, which they can legitimize as useful for the economic development, industrialization, and reputation of their country, although

8.Money, money, money

The available data on the business deals of RWM Italia and RDM might suggest that relevant shares of the profits of the Rheinmetall Group in the military business result from the ammunition business of these two foreign firms. The order book in the Weapons and Ammunition division and the plans for expansion of the two Group companies make it seem

likely that this will remain the case in the coming years.

Both firms show a rapid growth in sales, and yield sufficiently high profits to be able to pursue three goals simultaneously: part of the profits is paid out to the shareholders, another part can be re-invested to expand these firms, and a third part can serve to increase the equity capital in accordance with statutory requirements, in order to make it able to handle larger orders and development projects to strengthen local intellectual-property rights.

RDM contributed a total of about 65 million euros to the earnings of its parent company RWM from 2013 to 2017, of which 22.7 million was in 2017 alone. For RWM Italia it was about 34 million euros during that period, of which 15.8 million were generated in 2017. RWM also reports in its 2016 financial statement that each employee of the firm generated 468,000 euros in sales in that year. At Rheinmetall Defence, it was „only“ 243,000 euros per

employee in the same year. Over the same period, RDM’s equity capital increased step-by- step from 41.9 million euros to 113.9 million euros. At RWM Italia, it increased over this period from 13.7 million to 53.5 million euros.

Both firms profited in this period above all from their business with MENA countries that are involved in the war in Yemen. Saudi Arabia and the UAE are also known for paying very good prices for arms shipments, especially if the interests of the ruling families are also served. As is so often the case: if business flourishes, morals are soon ignored. Today as in the past. In Germany and under German responsibility abroad.

9.Literature and sources

- Leitzbach, Christian: Rheinmetall – Vom Reiz, im Rheinland ein großes Werk zuerrichten, Cologne, 2014

- Nassauer, Otfried: Hemmungslos in alle Welt – Die Munitionsexporte der Rheinmetall

AG, Berlin, 1st edition 2016, 2nd updated and revised edition 2018, forthcoming - Rheinmetall AG: Werte. Wandel. Wachstum. – Nachhaltigkeitsbericht 2017,

Düsseldorf, 2017

Annual financial statement

- Rheinmetall AG: Geschäftsbericht 2017, März 2018, on the Web:

https://ir.rheinmetall.com/download/companies/rheinmetall/Annual%20Reports/DE0007030009-JA-2017-EQ-D-01.pdf - Rheinmetall AG: Geschäftsbericht 2016, März 2017, on the Web:

https://ir.rheinmetall.com/download/companies/rheinmetall/Annual%20Reports/DE0007030009-JA-2016-EQ-D-00.pdf - Rheinmetall AG; Geschäftsbericht 2015, März 2016, on the Web:

https://ir.rheinmetall.com/download/companies/rheinmetall/Annual%20Reports/DE0007030009-JA-2015-EQ-D-03.pdf - Rheinmetall AG: Geschäftsbericht 2014, März 2015, on the Web:

https://ir.rheinmetall.com/download/companies/rheinmetall/Annual%20Reports/DE0007030009-JA-2014-EQ-D-00.pdf - Rheinmetall AG: Geschäftsbericht 2013, März 2014, on the Web:

https://ir.rheinmetall.com/download/companies/rheinmetall/Annual%20Reports/DE0007030009-JA-2013-EQ-D-00.pdf